Note: I am not a financial advisor, so please don’t consider this as financial advice. This is just my learning over the past 10 years of investing my earnings.

2010

I lost my job twice in 2 months (Thank you Digitas & PUMA North America!). I decided to packup everything and come back to India. It was a tough decision.

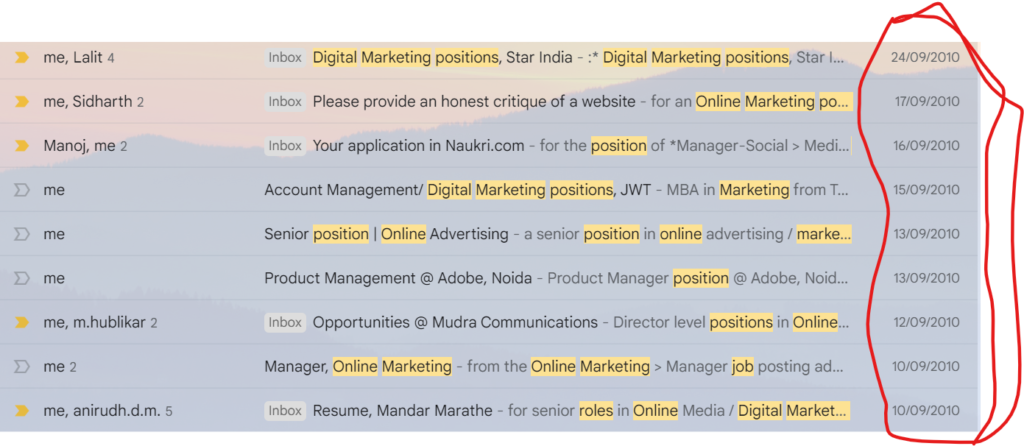

Sept 22, 2010, I landed in Mumbai with a few interviews lined up with digital marketing agencies in Mumbai.

I cracked 3 interviews – WebChutney offered me 4.8 Lac, Ogilvy a paltry 3.6 and Interactive Avenues offered 15 Lac. I made the obvious choice.

2013

October 2013. I put down my papers at Reprise Media (Interactive Avenues IPG arm) and took the plunge.

From earning $75k in Boston to 15 Lac (~$33k) in Mumbai to Rs. 20k/month i.e. 2.4 Lac / year in 2011.

Literally, took the plunge!

Now, I had some $20k in savings from U.S. out of which I put ~7 Lac ($15k) towards a down payment on a home loan of 40 Lac.

2013 December, Savings = Rs. 2.5 Lac in bank.

2014

The first few years of Briefkase (the digital agency I started in 2014) were tough. By 2018, I managed to pay myself Rs. 1 Lac monthly salary, still lower than what I earned in 2010.

2020

2020 COVID strikes, and I left BriefKase for another startup Koppr. My friend Snehal was generous to fund this personal finance startup and pay me well as CEO.

April 2020 is when I actually started investing whatever I had left with me after taking care of family expenses.

As a startup founder who has to constantly manage cashflows – personal cash flows as well as company cash flows, I have these learnings:

- Have multiple streams of income

- Live below your means

- Cut down on unwanted expenses – Buying a car / kidney-priced iPhones etc.

- Invest 40% of your earnings

- Do not compromise on your health / fitness – Go to the gym or play a sport

- Spend time with friends & family

- Balance is important and difficult to maintain

- Get a financial advisor

- Time = Money

- Cut-off people who don’t add value to your life and are a time-suck.

- I will cover these learnings in another post.

Okay, I’ve digressed.

Or may be this is just a build up to my Beloved 3 P’s.

The 3 P’s of my personal finance – Here we go!

1. Paycheck

You must always have a paycheck. Not one, but multiple monthly paychecks.

One thing I learned from Americans is that people work really hard, even students (most have education loans to repay). Most people take up multiple jobs to bring food to the table. And its Ok in America to do multiple things.

In India, employers look down upon employees who have multiple jobs. This is changing with today’s GenZ – They give a hoot about a job. They switch. Every year. They leave a job without having another one. They take career breaks. They freelance. They enjoy life.

Whether you are GenZ / Millenial / In your early thirties / Late forties – Have multiple paychecks till you build multiple streams of income that come from other P’s.

Before we get there, what do you do with your paychecks?

Don’t buy that gas-guzzling o-80 in 6 seconds car to drive on pot-holed filed roads. Don’t buy that 1 kidney = 1 iPhone 16 phone. Don’t smoke or booze or do drugs. Have seen many a people around me do this and put their paychecks down the drain.

Genuine advice to my 23 year old self who had a Rs. 14k / month salary at Infosys. INVEST.

Invest 40%, even 50% of your earnings.

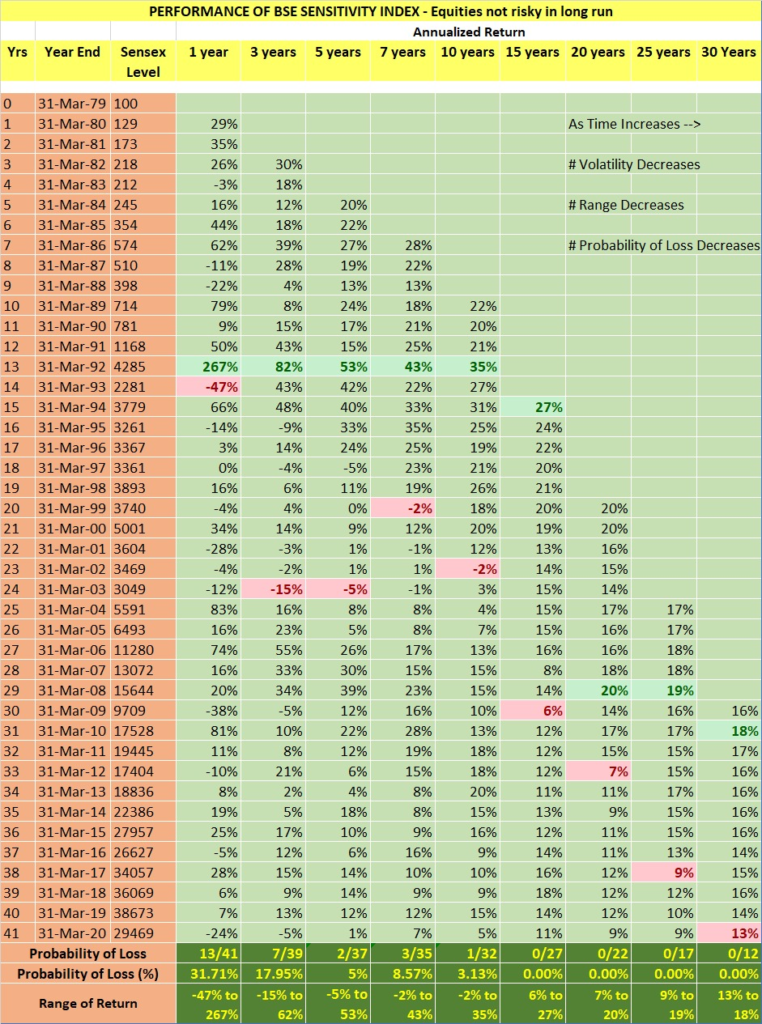

The easiest way to invest is to start a SIP. If you are Harshad Mehta / Jordan Belfort / think that you are smart enough to time the market and pick the right stocks, then do that.

For 99% of the people, who can’t beat the market, why not act sane and meet the market?

This brings me to my 2nd P of P P P Piya…

2. Portfolio

Over a period of time, you should look at building a huge portfolio. Consider this

1 Crore invested in mutual funds will give you 1 Lac per month of portfolio income (12% avg. returns). Also, your portfolio doubles every 7-8 years at this rate. Patience Lago, Patience.

Some ways of growing your portfolio (again, not financial advice, but my learnings)

- Invest in Index Mutual Funds

- Invest in a variety of mutual funds – small cap, mid cap and large cap so that you have a diversified portfolio

- Put some money in debt (Govt bonds)

- Put some money in FD’s (just to cover inflation and for emergency funds – approx 6 months of your salary)

- Once you get to a 1 Cr+ portfolio, invest in a PMS (thats 50 Lac minimum)

- Get a health and life insurance policy – I have Term Insurance & Mediclaim

- Don’t take advice from your friend (unless, he is a trader / a fund manager)

- Keep aside some funds to invest when there is a black swan event i.e. COVID = market fell 60% = I invested. As Warren Buffet puts it, be greedy when everyone is being fearful.

- Have an overall diversified portfolio – MFs, Direct equities, Gold, Bonds, PMS. Don’t put all your eggs in 1 basket.

This brings me to the 3rd & final P! Dhirubhai ka sapna, sabka maal apna…

3. Passive Income

Well, passive income is not 100% passive. It’s just less active. On a scale of 1 to 10, where 1 is active and 10 is passive, Paycheck would be a 1/2, portfolio would be a 4/5 and passive income would be a 9/10.

Definition : Passive income is income where you dont have to invest your time or resources to earn more income.

i.e. Your money makes more money

i.e. Someone else works for you and you make more money

i.e. Something you bought in the past (e.g. house) makes you money.

Some of the sources of passive income:

- Rental income (from property)

- Dividends from stocks

- Ad revenue & affiliate marketing

- Automated business – Thats why you see so many guru’s selling these recorded make more money webinars / video courses

- Royalties (from books / music videos / YouTube videos)

P.S. I did launch courses few years ago (mandar.thinkific.com) but have vowed not to resort to “Make Epic Shit” ever again!

Conclusion

P P P Piya……….Piya tune mera Jiya Le Liya.

I am working towards building passive income via real estate and royalties (Book launching soon in 2027!)

My portfolio income is stable.

My windfall paycheck will come in when there is an exit event. Soon, like 2030 types soon.

I hope that…

Meine jo kiya, vahi tune bhi kiya…. P P P Piya!

Shameless plug. Jao YouTube pe kisi ko passive income dedo…