I have been thinking about this for some time now. What If I had ₹10 Crore sitting in my bank account today? Will I be living my life differently than what I am doing today?

Why 10 crore? Why not 20, 50 or even a 100 crore?

For me 10 crore would be enough “fuck off money” to do anything that I want. It would also be enough to manage all future expenses of my family (wife and 2 kids) including kids education, vacations, monthly expenses, medical bills etc. with a caveat that I would invest the 10 crore wisely.

- 10 Crore gives you 1 Crore annual passive income, considering a conservative 10% return. Assuming a monthly expense of 4 Lac, that’s still 52 Lac left, which can be invested again.

- 10 Crore becomes 20 Crore in 7-8 Years at a growth rate of 12% per annum, if invested in index mutual funds. It could be more if given to a wealth manager or invested in good stock picks.

- 10 Crore is enough as I don’t have extravagant expenses / desires of flying on a private jet or buying a beach facing villa or a fancy car that goes 0 to 100 in 10 seconds.

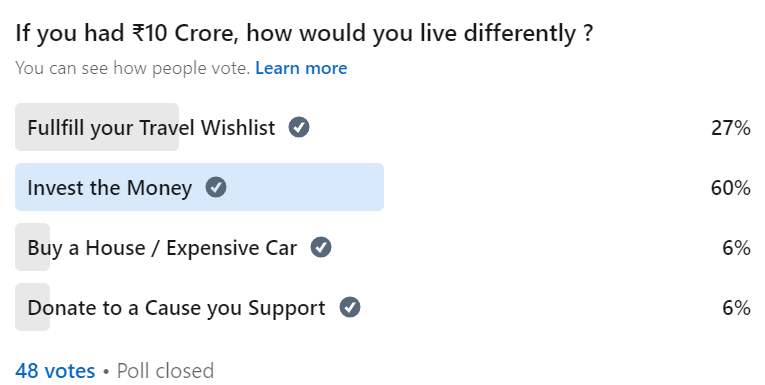

What would most professionals do if they had 10 Crore?

I launched this poll on LinkedIn. Most professionals (60%) made a wise choice of investing the funds they received and 27% chose to fulfill their travel wishlist

My good friend Bankim Bhavsar pointed out that there should have been a F.I.R.E option as a part of the poll answer options. FIRE is Financially Independent Retire Early. Here is the Reddit thread for the F.I.R.E movement, which mostly has participation from U.S. nationals.

Now, I don’t completely buy in to the F.I.R.E movement as I don’t plan to retire at all.

What would I do with 10 crore today?

There are certain things that I would want today and certain things where I’d be happy with delayed gratification. I’ll try to jot down my thoughts w.r.t different areas of my current life and how they would or would not change.

1. Work

It would be safe to say that I would not retire from working – I’d be involved with a startup / my current business or consulting with small businesses – This is where I’d focus part of my work-life to generate a small income for monthly sustenance. I plan to start a business incubator for startups in the sports & fitness industry.

I’d dedicate most of my work life towards wildlife conservation or conscious tourism. I plan to get certified as a naturalist and invest time in operating wildlife tours. I plan to give time towards a non-profit focused on wildlfe / animal welfare. I’d also want to create content related to wildlife tourism and nature conservation.

2. Travel / Vacations

I take 25-30 days of vacation now and I’m beyond doubt sure that this would 3 X if I had 10 Crore. That means 90 days of vacation in a year!

Places I’d like to go / vacations I’d like to take:

- African Safari (Kenya & Tanzania)

- 30-day South America tour (including Patagonia, Galapagos & Easter Islands)

- All states of India

- Alaska in a RV

- A month in Ladakh

- A month in Tadoba wildlife sanctuary, Maharashtra

- Watching India play at Lords (UK), MCG, SCG (Australia), Newlands (South Africa)

3. Investing

10 Crore today would need to be invested wisely to financially secure my family. It would mean that I invest 90% of the funds (9 Cr) across various instruments.

9 Crore would mean a annual passive income of 90 Lac (72 Lac after 20% short-term capital gain tax). This would be more than enough to sustain my families lifestyle as well as invest the remainder for further compounding. Here is the break up of 9 Crore investment:

- 3 Crore (33%) would be invested across 3 Portfolio Management Services (PMS) Wealth Management companies

- Another 2 Crore (22%), I would cherry pick long-term stocks, mostly large cap companies that are a part of the NIFTY50 index.

- 1 Crore (11%), I would invest in Gold – a mix of physical gold bars, Gold ETFs, and sovereign gold bond schemes

- The remainder 3 Crore (33%) would be invested in Mutual Funds with a SWP (Systematic Withdrawal Plan) – Assuming a 12% steady growth, that would give 36 lac return per annum. I’d withdraw 6% of the 3 Crore (18 Lac) for monthly expenses

Would I need to take a loan ? Well, I’d encourage my kids to take a loan for higher education or to purchase a house. I’d be happy to make the down payment from the returns generated from my investments.

4. Health & Fitness

I invest a lot of time in staying healthy, mainly working out at the gym or swimming. I would not change that. I’d definitely upgrade to a high-end gym and opt for a personal trainer. This would cost me around ₹2.5 – 3 Lac a year.

On the food & nutrition side, I’d definitely sign up for a service that offers personalised meal plans as well as prepares these meals keeping a track of calories. This wouldn’t cost much – around ₹4-5 Lac/annum. Also, my choice of eating out would be at more fancier restaurants that offer healthier meal options.

5. House / Property

My current real estate investments (all residential properties) are a big % of my net worth and they are located in metros. Over the next 6-7 years, I am looking to move out of Thane and shift base to a Tier-II / Tier-III city in India.

My choices would be:

- Nagpur (centrally located, airport, medical facilities, closer to wildlife sanctuaries, growing city)

- Indore (clean, airport, medical facilities, value for money housing, growing)

- Dehradun (mountains!, airport, schools, medical facilities)

I’d utilise 10% of 10 Crore to invest in buying a 4-5k sqft of land and build a house. I have a few things in mind in terms of what kind of a house I want

- Enough space for a garden / greenery

- A small personal gym

- Kerala style traditional courtyard where the rain is invited

- Mid-century modern interior design

- Preferably in a gated community in company of other like-minded friends

6. Charity

I have not been giving to charity much. And I’d like to correct that. I think its important for a wealthy person to give back to the society. Here are some ideas of charity I have.

- Support education of 10 under-privileged school kids every year

- Support a wildlife conservation non-profit with a monetary donation every year

- Support a local animal welfare shelter with a monetary donation every year

- Spend time teaching underprivileged kids (either business fundamentals, marketing or basic internet skills)

Wherever possible, I’d want to maintain anonymity in my charitable deeds.

Conslusion

My goal is to continue to collect money and power, and then use it for positive influence on causes which I care about.

If I had ₹10,00,00,000 in cash, I’d make sure that my life was easier and a lot more fun.

very insightful Mandar Marathe. Does this target include own home or assuming rental home?

Real estate is not considered. This is liquid net worth.